एमबीए चायवाला बिजनेस में क्यों फेल हो गया

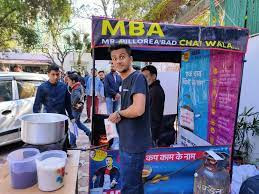

Why MBA CHAIWALA FAILED IN BUSINESS

I was about to make my post title :-

"How do I stop MBA Chaiwala from coming on my IG feed?" No matter how many videos I check on "not interested" it keeps showing me MBA chaiwala motivational crap.

First off,

I cannot stand that guy.

He is more of an influencer over an entrepreneur. He has many people seemingly in his office reposting his videos on his fan accounts. Just rubbish.

A true entrepreneur will not even bother to intimidate people on social media under the pretext of motivation. He just wants fans and attention. And that's fine. I don't want him to pop on my feed every second. I have never known about any of his cafes in Mumbai. But I have heard his cafe is overrated as well and it is good only for influencers. The actual food and tea is very average.

A complaint of fraud has been registered against MBA Chaiwala, who has emerged as an inspiration for all youths as a young entrepreneur. Yes, fraud cases have been registered against Prafulla Billaure and his brother Vivek Billaure's father Sohanlal, who started a startup in the name of MBA Chaiwala. Complaints of fraud have been registered regarding this from Indore to Prayagraj. These complaints have been made by different franchisees. Not only this, all of those who filed complaints are young.

As Prafulla Billore had promised to his franchise customer that selling tea per day would be more than 10000, he had talked about 30-60% profit, but it could never happen that selling a normal tea per day would be 10. ,000, this clears one thing, Praful Billore kept everyone in the dark from the very beginning, let's assume for once that 10,000 worth of tea was sold daily, it is not possible because now if we talk about test tea So that's nothing special beyond average

All those who opened their franchise have filed a case against the company, the company has defrauded us.

mba Chaiwala's founder MR Billore has said that everything is going well and someone is spreading rumors against his company that the company is doing fraud BUT there is nothing like that everything is right some people are spreading rumors and demanding money from them.

There is one thing which is very common in India, one who became famous through social media, people make him a hero and if he did 1-2 works, then he would have made him a star, the same happened with the founder of MBA Chaiwala, he used social media as normal. Became famous on social media by showing Tia stall's startup, then became a motivational speaker by taking help of tea business, and then became famous in youth, then started MBA Chaiwala's outlet, then by giving an unprofessional fraud business model, I only kept people in dhoka but Praful ji made a mistake.

They forgot that the business is not run by the name but by the best business management and by lying to the people and showing them big dreams, they started their outlets, all the outlets they opened were on the verge of closure after 2 months. Everything is in loss, a franchisee of Indore has filed a case against them, which has gone to the Prayagraj High Court.

All their outlets which were opened in today's date are getting closed slowly. The biggest failure of MBA Chaiwala is that they do not belong to the basic structure of professional franchise business, only use the fame of name.

एमबीए चायवाला बिजनेस में क्यों फेल हो गया

मैं अपनी पोस्ट का शीर्षक बनाने ही वाला था :- "मैं MBA चायवाला को अपने IG फीड पर आने से कैसे रोकूँ?" चाहे मैं "दिलचस्पी नहीं" पर कितने भी वीडियो देखूं, यह मुझे MBA चायवाला प्रेरक बकवास दिखाता रहता है। सबसे पहले, मैं उस आदमी को बर्दाश्त नहीं कर सकता। वह एक उद्यमी से अधिक प्रभावशाली है। उनके कार्यालय में कई लोग हैं जो उनके वीडियो को उनके प्रशंसक खातों पर दोबारा पोस्ट कर रहे हैं। बस बकवास।

एक सच्चा उद्यमी प्रेरणा के बहाने सोशल मीडिया पर लोगों को डराने की जहमत भी नहीं उठाएगा। वह सिर्फ प्रशंसक और ध्यान चाहता है। और वह ठीक है। मैं नहीं चाहता कि वह हर सेकंड मेरे फीड पर पॉप करे। मैं मुंबई में उनके किसी कैफे के बारे में कभी नहीं जानता। लेकिन मैंने सुना है कि उनका कैफे भी ओवररेटेड है और यह केवल प्रभावित करने वालों के लिए अच्छा है। वास्तविक भोजन और चाय बहुत ही औसत है।

युवा उद्यमी के रूप में तमाम युवाओं के लिए प्रेरणा बनकर उभरे एमबीए चायवाला के खिलाफ धोखाधड़ी की शिकायत दर्ज की गयी है. जी हां, एमबीए चायवाला के नाम से स्टार्टअप शुरू करने वाले प्रफुल्ल बिल्लौरे और उनके भाई विवेक बिलौरे के पिता सोहनलाल के खिलाफ धोखाधड़ी का मामला दर्ज किया गया है. इसको लेकर इंदौर से लेकर प्रयागराज तक धोखाधड़ी की शिकायतें दर्ज की गई हैं। ये शिकायतें अलग-अलग फ्रेंचाइजी ने की हैं। इतना ही नहीं शिकायत करने वाले सभी युवा हैं।

जैसा कि प्रफुल्ल बिल्लोरे ने अपने फ्रेंचाइजी ग्राहक से वादा किया था कि प्रति दिन चाय बेचने से 10000 से अधिक होगा, उन्होंने 30-60% लाभ की बात की थी, लेकिन ऐसा कभी नहीं हो सकता था कि प्रति दिन एक सामान्य चाय बेचने से 10.000 हो जाए, यह एक बात साफ हो जाती है, प्रफुल्ल बिल्लोरे ने शुरू से ही सबको अंधेरे में रखा, एक बार के लिए मान लेते हैं कि रोजाना 10,000 रुपये की चाय बिकती थी, यह संभव नहीं है क्योंकि अब टेस्ट चाय की बात करें तो यह औसत से कुछ खास नहीं है

जिन लोगों ने अपनी फ्रेंचाइजी खोली है, उन सभी ने कंपनी के खिलाफ केस किया है, कंपनी ने हमें धोखा दिया है।

mba Chaiwala के फाउंडर MR Billore ने कहा है कि सब कुछ ठीक चल रहा है और कोई उनकी कंपनी के खिलाफ अफवाह फैला रहा है कि कंपनी फ्रॉड कर रही है लेकिन ऐसा कुछ नहीं है कि सब कुछ सही है कुछ लोग अफवाह फैला रहे हैं और उनसे पैसे की मांग कर रहे हैं.

भारत में एक बात बहुत कॉमन है, जो सोशल मीडिया से फेमस हो जाता है लोग उसे हीरो बना देते हैं और अगर वो 1-2 काम करता तो उसे स्टार बना देता, ऐसा ही MBA के फाउंडर के साथ हुआ चायवाला, उन्होंने सोशल मीडिया का सामान्य रूप से उपयोग किया। टिया स्टॉल का स्टार्टअप दिखाकर सोशल मीडिया पर मशहूर हुए, फिर चाय के बिजनेस का सहारा लेकर मोटिवेशनल स्पीकर बने, फिर जवानी में मशहूर हुए, फिर एमबीए चायवाला का आउटलेट शुरू किया, फिर अनप्रोफेशनल फ्रॉड बिजनेस मॉडल देकर लोगों को ही फंसाए रखा धोखा लेकिन प्रफुल्ल जी से गलती हो गई।

वे भूल गए कि व्यापार नाम से नहीं बल्कि बेहतरीन बिजनेस मैनेजमेंट से चलता है और लोगों से झूठ बोलकर और उन्हें बड़े-बड़े सपने दिखाकर अपना आउटलेट शुरू किया, उनके द्वारा खोले गए सभी आउटलेट 2 महीने बाद बंद होने के कगार पर थे। सब कुछ घाटे में है, इंदौर की एक फ्रेंचाइजी ने उनके खिलाफ मुकदमा दायर किया है, जो प्रयागराज हाईकोर्ट में गया है.

उनके सभी आउटलेट जो आज की तारीख में खुले थे, धीरे-धीरे बंद हो रहे हैं। एमबीए चायवाला की सबसे बड़ी विफलता यह है कि वे पेशेवर फ्रेंचाइजी व्यवसाय के मूल ढांचे से संबंधित नहीं हैं, केवल नाम की प्रसिद्धि का उपयोग करते हैं।

Why MBA CHAIWALA FAILED IN BUSINESS

#openings #foodandbeverage #tealovers #foodandbeverageindustry #foodandbeverage #indore #foodblogger#mbachaiwala, #linkedin, #motivation, #inspiration, #entrepreneurship, #startup, #linkedinforcreators

.jpg)

.jpg)

.jpg)